HONOR’s overseas operations have evolved into a central pillar of its growth strategy, underpinned by strong shipment momentum, a clear mid-to-high-end positioning, and a stratified regional expansion model spanning Europe, Latin America, the Middle East & Africa, and South-Eastern Asia. As this international footprint scales, the next phase of growth will depend on how effectively HONOR manages supply-side risks, deepens localisation across key markets, and monetises AI-led services beyond its core hardware portfolio, according to information from Omdia.

Overseas Markets Take on a Bigger Role

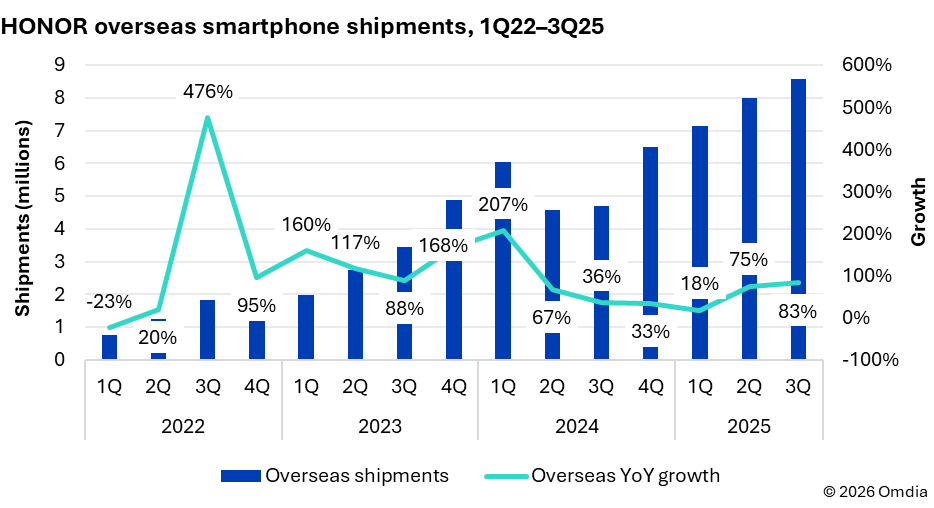

HONOR’s overseas smartphone shipments grew by approximately 55% year-on-year between 1Q and 3Q 2025, the fastest growth recorded among the world’s top ten smartphone vendors during the same period. This performance underscores the rapidly rising contribution of international markets to HONOR’s overall business.

Over the past five years, HONOR’s international business has undergone a structural transformation. In early 2021, overseas shipments accounted for less than 10% of total global volume. By 3Q25, that share had climbed to nearly 50%, marking a clear strategic inflection point. Overseas markets are no longer a peripheral source of incremental shipments; they now represent a foundational pillar supporting scale, geographic diversification, and long-term operational resilience.

However, headline shipment growth alone does not fully capture the quality or sustainability of this expansion. To assess HONOR’s long-term overseas prospects, it is necessary to look more closely at regional contributions, product mix, pricing strategy, and go-to-market execution.

Figure 1: With overseas shipments growing 55% in 1Q–3Q25, HONOR is establishing itself as a global smartphone player (Source: Omdia).

A Mid-to-High-End Strategy with Disciplined Execution

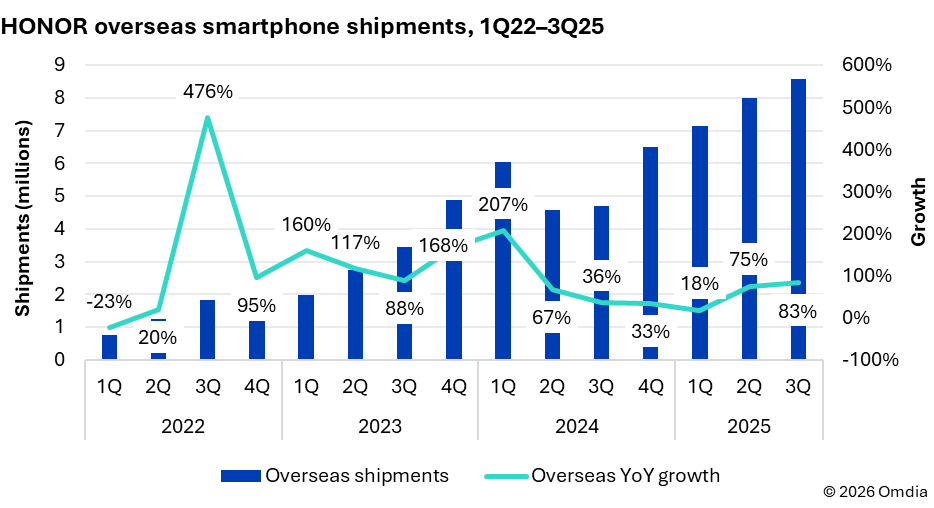

Across overseas markets, HONOR has deliberately focused on the mid-to-high-end segment. In many emerging regions, incremental smartphone demand remains concentrated below the $200 price point—a segment that is highly competitive and structurally constrained on margins. While several Chinese vendors continue to rely heavily on entry-level volumes, HONOR has prioritised the $300–499 price band, which accounted for around 23% of its overseas shipments in 1Q–3Q25, the highest share among major Chinese brands.

This positioning places greater emphasis on brand discipline, channel control, and product differentiation, rather than pure volume expansion. HONOR’s progress reflects a coordinated go-to-market strategy spanning channels, products, and marketing:

-

Channel: Deeper engagement with branded retail stores and key account partners strengthens control over consumer touch points and brand presentation.

-

Product: Device development is increasingly shaped by local consumer insights. In many markets, HONOR is associated with strong battery life and durability, with models such as the X9d, HONOR 400, and Magic V5 resonating with local preferences.

-

Marketing: AI feature education extends beyond media campaigns and is embedded at the channel level, with in-store demonstrations at branded outlets and major retailers accelerating consumer understanding and adoption.

Figure 2: HONOR’s overseas ASP trajectory reflects its premium-oriented expansion strategy (Source: Omdia).

A Stratified Regional Expansion Model

HONOR’s overseas business is underpinned by a clearly differentiated regional strategy:

Europe: Anchoring Premiumisation

Europe remains the cornerstone of HONOR’s premium push. Between 1Q and 3Q25, HONOR sustained a top-five position in major Western European markets such as the UK and France. The Magic V5—differentiated by its slim form factor, battery performance, and integrated AI features—helped HONOR secure second place in Western Europe’s book-style foldable segment.

At the same time, investment continues in Central and Eastern Europe, where shipments grew by 15% over the same period. Channel expansion and brand-building efforts are translating into tangible traction, supporting Europe’s role as both a profitability anchor and a brand showcase.

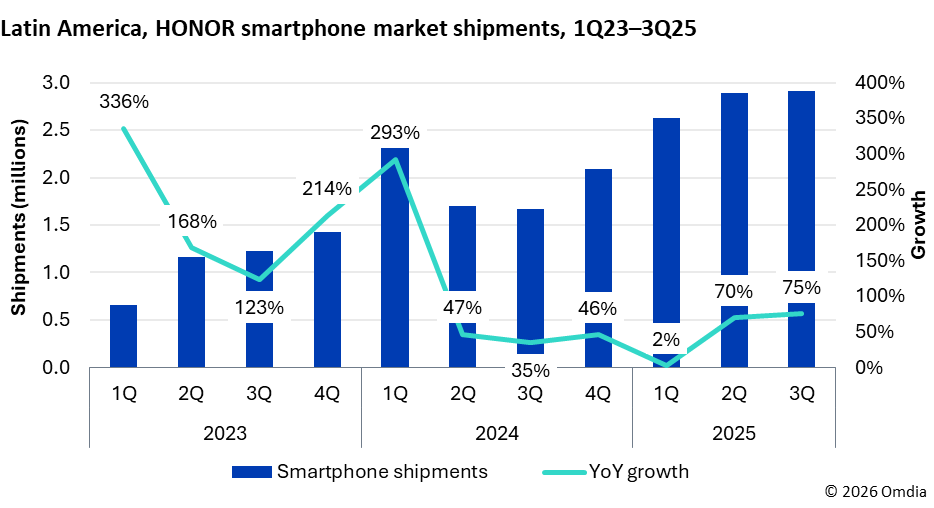

Latin America: The Volume Backbone

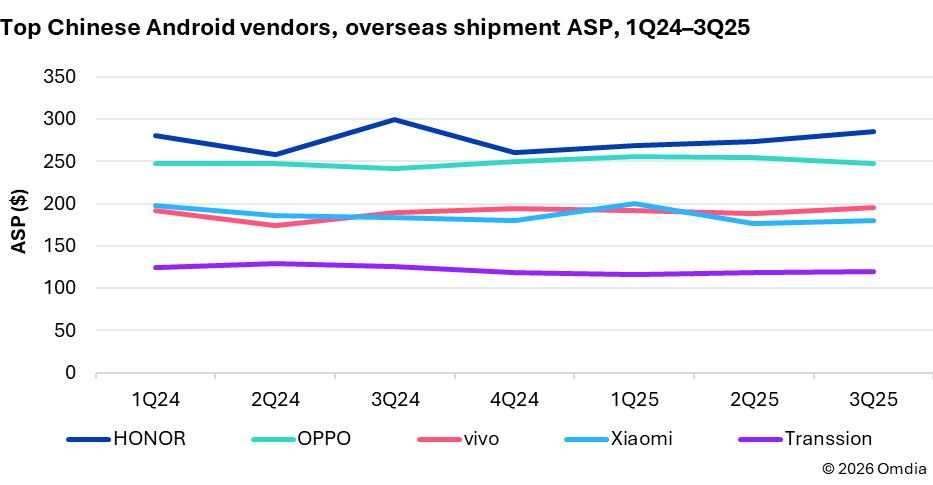

Latin America remains HONOR’s largest overseas volume contributor. The company has consolidated its position in core markets such as Mexico and Central America while expanding selectively across the region.

HONOR’s success here reflects strong alignment with the region’s operator-led channel structure, an area where the company has accumulated significant execution experience. While Mexico and Central America continue to anchor volumes, markets such as Ecuador and parts of the Caribbean are emerging as incremental growth drivers, improving the overall resilience of HONOR’s regional footprint.

Looking ahead, Latin America also benefits from favourable structural tailwinds. The 2026 FIFA World Cup, co-hosted by the US, Mexico, and Canada, is expected to stimulate consumer demand and telco-led promotional activity, creating a supportive environment for further market consolidation and gradual portfolio up-trading.

Figure 3: Latin America serves as HONOR’s core overseas volume contributor (Source: Omdia).

Latin America – HONOR Key Market Performance (YTD 3Q25)

| Market | Shipments Growth | Market Share | Shipments Ranking |

|---|---|---|---|

| Peru | 5% | 21% | 3 |

| Central America | 48% | 20% | 2 |

| Caribbean | 122% | 16% | 3 |

| Ecuador | 89% | 10% | 4 |

| Mexico | 7% | 8% | 5 |

| Brazil | 478% | 1% | 8 |

Source: © 2026 Omdia

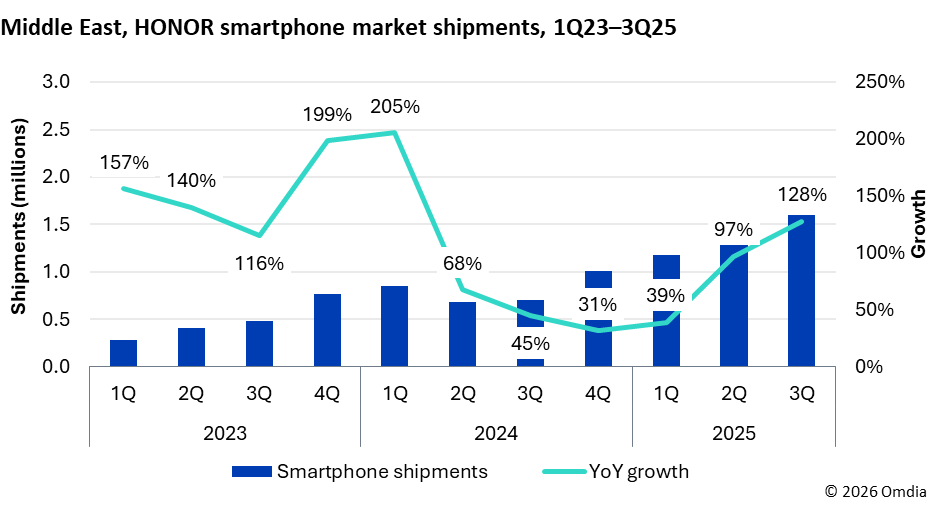

Middle East & Africa: The Primary Growth Engine

The Middle East & Africa region has emerged as HONOR’s most important incremental growth engine, with shipment volumes approaching those of Latin America. The Middle East, in particular, aligns well with HONOR’s premiumization strategy due to relatively high purchasing power and mature retail infrastructure.

HONOR has prioritised deep cooperation with operators, national electronics retailers, and branded retail formats across key Gulf Cooperation Council markets. This focus enhances brand visibility, pricing control, and ASP uplift. Meanwhile, selected frontier markets continue to deliver incremental volume as distribution expands.

Middle East – HONOR Key Market Performance (YTD 3Q25)

| Market | Shipments Growth | Market Share | Shipments Ranking |

|---|---|---|---|

| Iraq | 105% | 19% | 3 |

| Qatar | 252% | 9% | 4 |

| Saudi Arabia | 30% | 9% | 4 |

| UAE | 31% | 9% | 4 |

| Kuwait | 234% | 7% | 4 |

Source: © 2026 Omdia

From a portfolio perspective, the midrange segment remains the primary volume driver, while flagship devices reinforce brand credentials within premium channels. In-store AI demonstrations and experiential retail initiatives further support consumer engagement and sustainable growth.

Figure 4: The Middle East was HONOR’s key growth engine in 2025 (Source: Omdia).

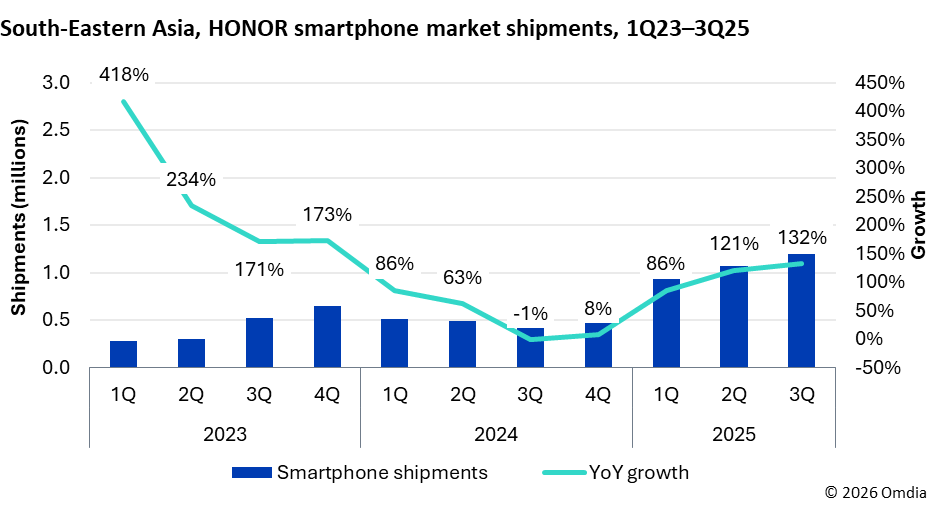

South-Eastern Asia: Building the Next Growth Curve

South-Eastern Asia is shaping up as HONOR’s next growth frontier, supported by localisation and channel investment. Indonesia plays a strategic role, with local manufacturing initiatives improving supply resilience, cost structure, and regulatory alignment in the region’s largest market.

| Market | Shipments Growth | Market Share | Shipments Ranking |

|---|---|---|---|

| Malaysia | 40% | 12% | 4 |

| Philippines | 177% | 5% | 7 |

| Thailand | 106% | 5% | 6 |

| Singapore | 156% | 4% | 5 |

| Vietnam | 139% | 3% | 7 |

Source: © 2026 Omdia

Malaysia, meanwhile, functions as a regional brand and service hub. The opening of flagship retail stores and expanded service-centre coverage highlights HONOR’s focus on strengthening consumer trust and after-sales capabilities. As regional demand shifts toward higher expectations around quality, service, and experience, HONOR’s localised approach provides a foundation for sustainable scale and gradual ASP expansion.

Figure 5: HONOR is building its next growth curve in South-Eastern Asia (Source: Omdia).

Key Challenges and Opportunities Ahead

Despite its phased progress overseas, HONOR faces a more complex operating environment going forward. On the supply side, rising NAND and DRAM prices introduce cost and availability risks. While higher overseas ASPs provide some margin insulation, HONOR’s smaller scale relative to global leaders limits its bargaining power, particularly for midrange models with higher memory configurations.

AI is another critical pillar of HONOR’s international strategy. Operating within Google’s ecosystem constrains platform-level differentiation, increasing the importance of localised AI experiences. The central challenge is whether HONOR can translate its growing overseas user base into recurring, service-driven revenue rather than relying solely on hardware margins.

Emerging markets represent the next leg of overseas expansion but also bring higher cost sensitivity and stricter localisation requirements. HONOR has initiated local manufacturing in markets such as Indonesia and Bangladesh in 2025, but these efforts remain nascent. Compared with peers that operate mature, large-scale overseas manufacturing ecosystems, HONOR’s local capacity is still limited, potentially weighing on cost optimisation and operational agility as volumes scale.